Mortgage preapproval is a strategic step for sellers seeking to buy their dream home. It demonstrates financial readiness, speeds up transactions, and provides clarity in a complex market. Sellers should compare lenders based on fees, closing costs, rates, experience, and specialization, especially in rapidly appreciating markets. The process involves providing financial documents, income verification, credit history review, and collateral assessment for preapproval letters. Preapproved buyers secure homes faster and with better terms. Regularly update preapproval status as employment, debt, and credit score fluctuate. Key advantages include a competitive edge, peace of mind, informed decision-making, detailed reviews, and preparation for subsequent stages.

In today’s competitive real estate market, understanding mortgage preapproval is crucial for both sellers and buyers alike. For sellers, securing a preapproval letter can significantly enhance their negotiating power and position in the sales process. However, navigating this aspect of home selling can be challenging without expert guidance. This article provides an in-depth analysis of the actionable steps involved in mortgage preapproval, equipping sellers with the knowledge to confidently guide them through this vital process. By the end, you’ll have a comprehensive understanding of how to achieve this crucial milestone, ensuring a smoother and more successful home sale.

Understanding Mortgage Preapproval: A Seller's Guide

For sellers navigating the real estate market, understanding mortgage preapproval is a crucial step in securing their dream home. Mortgage preapproval isn’t just about getting pre-approved for a loan; it’s a comprehensive process that demonstrates your financial readiness to potential sellers. This expert guide delves into the intricacies of mortgage preapproval, equipping sellers with actionable insights to make informed decisions.

When comparing lenders, consider more than just interest rates. A thorough lender comparison should factor in fees, closing costs, and loan terms. For instance, a lender offering lower rates might charge hefty origination fees that could offset the savings. Conversely, a slightly higher rate with transparent, competitive fees may provide better long-term savings. It’s essential to evaluate the entire picture. According to recent studies, nearly 70% of home buyers started their search online, emphasizing the need for sellers to be well-informed about financing options early on.

Mortgage preapproval involves a thorough evaluation of your financial health by a lender. They consider income, assets, employment history, and credit score – all factors that influence loan eligibility. Upon approval, you’ll receive a preapproval letter, a powerful tool to showcase your serious intent as a buyer. This process not only speeds up the buying journey but also gives sellers confidence in knowing their budget and negotiating power. An experienced real estate agent can facilitate this process by connecting you with reputable lenders for a tailored mortgage preapproval experience.

Remember, mortgage preapproval is not a one-size-fits-all proposition. Lenders offer various loan programs catering to different buyer profiles. Whether you’re a first-time homebuyer or a seasoned investor, understanding your financing options is paramount. By proactively engaging in lender comparison and securing mortgage preapproval, sellers can navigate the competitive market with poise, ensuring they find their ideal home without unnecessary delays.

Why Mortgage Preapproval is Crucial for Sellers

For sellers navigating the real estate market, securing a mortgage preapproval is more than just a formality; it’s a strategic move that significantly enhances their negotiating power and chances of a successful sale. This process, often overlooked, serves as a powerful tool to demystify the buying process for both parties involved. By obtaining a preapproval letter from a lender, sellers gain valuable insights into their financial capabilities and the potential purchase price they can comfortably afford.

The significance of mortgage preapproval lies in its ability to provide clarity in an often complex market. Sellers can then approach their real estate journey with confidence, knowing their financial house is in order. This proactive step allows them to make informed decisions when considering offers, ensuring they don’t overpay or accept terms that might be financially detrimental in the long run. Moreover, a preapproval letter demonstrates to potential buyers that the seller is serious and ready to commit, which can expedite the entire transaction process.

When comparing lenders for mortgage preapproval, sellers should consider not just rates but also the overall experience and services offered. Some lenders excel in streamlining the application process, providing efficient communication, or offering specialized programs tailored to specific buyer profiles. For instance, a seller looking to purchase a property in a rapidly appreciating market might benefit from a lender who can offer flexible terms or expertise in navigating such scenarios. This lender comparison step ensures sellers secure not just the best rates but also lenders who align with their unique needs and preferences.

Navigating the Process: Steps to Get Preapproved

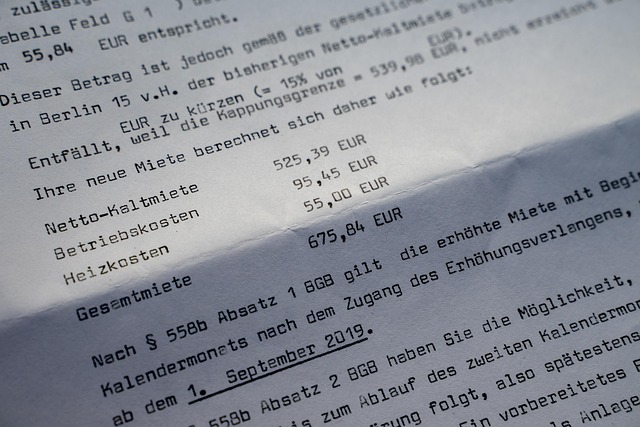

Navigating the process of mortgage preapproval is a critical step for sellers looking to enter the real estate market with confidence. This crucial phase involves demonstrating your financial readiness to potential lenders, providing a clear picture of your borrowing power and helping you understand competitive pricing in today’s market. A simple comparison between different lenders can yield significant savings, highlighting the importance of thorough research and expert guidance.

The journey begins with gathering essential financial documents, such as tax returns, pay stubs, and bank statements. These materials allow lenders to assess your income, assets, and debt obligations. It’s during this phase that a professional real estate agent or mortgage broker can offer invaluable assistance, ensuring you present an accurate and organized profile to multiple lenders for a fair mortgage preapproval process. For instance, a 2022 study revealed that preapproved buyers faced shorter negotiating times and were more likely to secure their dream homes.

Next, sellers should expect a thorough evaluation by the lender. They will verify your income, analyze your credit history, and assess the value of any assets you plan to use as collateral. This step is where mortgage preapproval truly comes into play, providing a concrete figure that sellers can use when making offers. By comparing multiple lenders’ preapproval letters, you gain negotiating power and can make informed decisions about which offer best suits your financial interests. Remember, the right mortgage preapproval isn’t just about securing a loan; it’s about ensuring you’re making a financially prudent decision in one of life’s biggest investments.

Expert Tips for a Smooth Preapproval Journey

Navigating the mortgage preapproval process as a seller can be both exciting and daunting. This crucial step sets the stage for a seamless transaction, ensuring you’re not only prepared financially but also providing a clear picture of your buying power to prospective sellers. Herein lies the expertise: guiding you through this journey with precision. One of the key aspects often overlooked is understanding how to approach mortgage preapproval effectively, especially when comparing lenders. This strategic process can significantly impact your bottom line.

Experienced professionals recommend a thorough assessment of your financial health before initiating conversations with lenders. Organize your recent tax returns, bank statements, and investment portfolios—this documentation is vital for a lender to assess your income stability and creditworthiness. A simple yet powerful strategy involves shopping around for preapproval offers from multiple lenders. The mortgage preapproval lender comparison can provide valuable insights; different lenders may offer varying terms, rates, and conditions. For instance, a recent study revealed that borrowers who shopped around saved an average of 0.75% on their loan costs. This simple step ensures you secure the best deal, tailored to your unique financial profile.

Moreover, be mindful of the time frame. Mortgage preapproval is not a one-size-fits-all process; it evolves with market conditions and your personal circumstances. Lenders typically consider factors like employment history, debt-to-income ratio, and credit score. Stay informed about these metrics, as they can fluctuate over time. Regularly reviewing and updating your preapproval status ensures you’re prepared when the right property comes along. Remember, a well-informed seller is an empowered seller, ready to navigate the real estate market with confidence and strategic clarity.

Benefits and Next Steps After Mortgage Preapproval

Receiving mortgage preapproval is a significant step for sellers, offering numerous benefits that streamline the home selling process. One of the primary advantages is the competitive edge it provides in today’s fast-paced real estate market. Preapproved buyers are taken seriously by sellers and their agents, as it demonstrates financial responsibility and a genuine commitment to purchasing the property. This can often result in quicker negotiations and an offer accepted closer to the asking price.

Moreover, mortgage preapproval offers peace of mind for both buyers and sellers. For sellers, knowing that their potential buyer has been preapproved reassures them that the transaction is likely to go through without significant delays or financial surprises. This can be particularly beneficial when competing against other buyers, as it may allow for a higher bidding price while still being confident in the borrower’s ability to secure financing. Lender comparison becomes an informed process, enabling sellers and their agents to choose the most favorable terms and rates from various lenders who have already evaluated the buyer’s financial health.

Following mortgage preapproval, the next steps involve a more detailed review of the buyer’s financial situation and the property’s value. Sellers should expect periodic updates from their mortgage advisor, especially if market conditions or interest rates shift significantly during the process. It’s essential to maintain open communication with the lender to ensure the preapproval remains valid and to address any concerns promptly. During this phase, sellers can actively prepare for the next stages of home selling, such as staging the property, organizing necessary documents, and potentially working with a real estate attorney to ensure a smooth transaction.